Our Policies

These policies are not from an ivory tower like those of the major parties.

01

Employing Local

Hiring local tradespeople helps our community by keeping money local, providing better service, and building connections. Local workers understand our needs and ensure jobs are done well. Supporting them strengthens our economy and makes our community better.

02

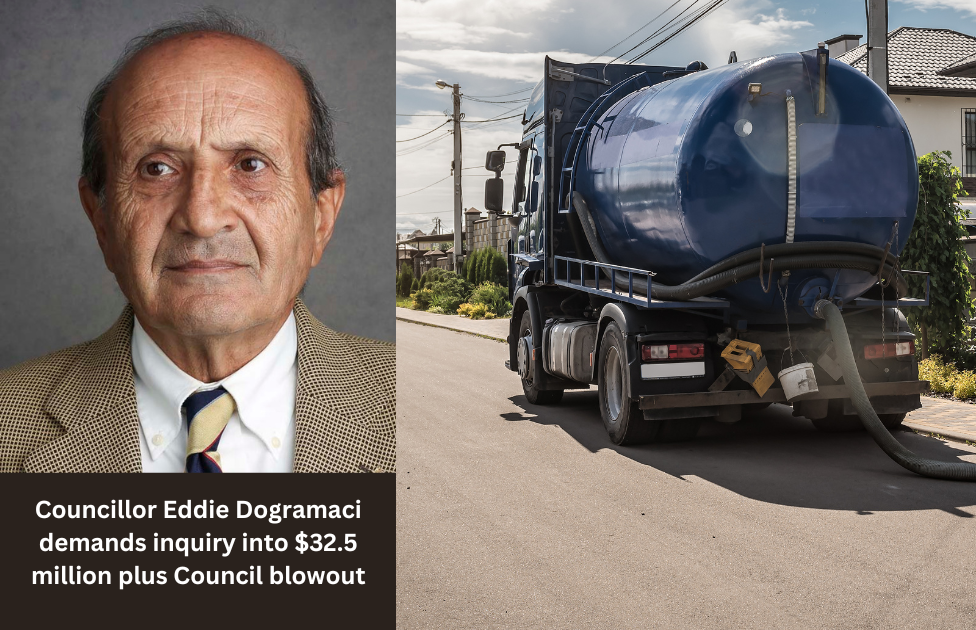

Stop Council Waste

Stopping council waste is essential. For example, the unnecessary $30 million spent on sewer repair in Windsor could have been avoided. By cutting such expenses, we can use funds for important community services. Transparency in spending will ensure taxpayer money is spent wisely, benefiting everyone. Let’s work together to eliminate waste and improve our community.

03

Make Rates Fair

By reducing land ownership rates, we can provide relief to hardworking families and stimulate economic growth. We will identify inefficiencies and find savings without compromising essential services. Our goal is to keep rates affordable while maintaining the quality of life our communities deserve.

04

Transparency

Action the needs and wants of rate payers and keep them informed.

05

Build a better Hawkesbury

Road upgrades, infrastructure upgrades, flood relief and appropiate DA approvals and response times. Plan for the future, for the young and the old.

Stay Connected with Us

Let’s Save The Hawkesbury

Become a member and raise your concerns with us.